Two investment accounts - Public Service

Investing for your future

Investment returns are vital to securing current and future pensions. Learn why investing is important and how the plan approaches responsible investment.

Two investment accounts

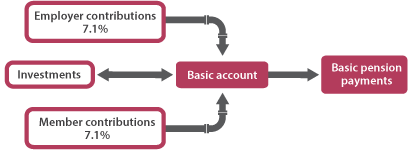

The basic account

Your guaranteed basic pension is paid from the plan’s basic account. Employer and member contributions are invested and the resulting funds are then used to pay pensions to retired members.

Your basic pension is guaranteed and payable for your lifetime. Depending on the options you choose at retirement, your spouse (if you have one) may receive a pension as well.

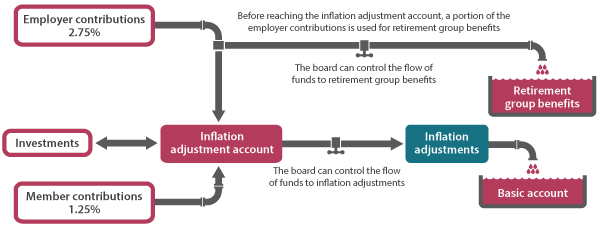

Inflation adjustment account

The board may grant a cost-of-living adjustment to your pension each year. This is called an inflation adjustment. The funds for these adjustments come from a portion of employer and member contributions that are put into the plan’s inflation adjustment account. These funds are invested, and returns from this account provide for inflation adjustments.

Receiving inflation adjustments is not guaranteed. But once you receive an inflation adjustment, it becomes a permanent part of your basic monthly lifetime pension. Please note: If you retire before age 65, the adjustments provided to your bridge benefit or temporary annuity end at age 65 as well.

Note: A limited portion of available employer contributions is used to fund retirement group benefits.