What is changing? - Public Service

Plan change details for retired members

Learn how certain plan changes affect you as a retired member

What is changing?

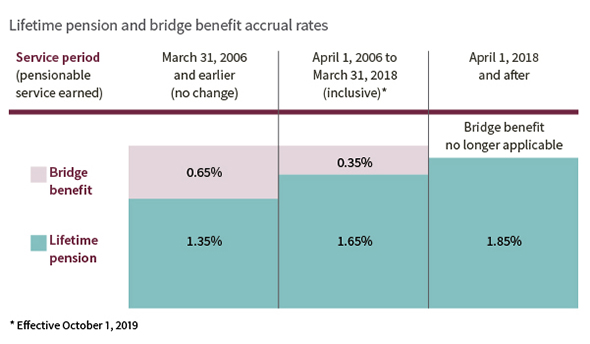

The accrual rate we used to calculate your pension is increasing for a specific time period. The accrual rate is one of the variables used to calculate your lifetime pension. It’s a multiplier that’s applied to your salary and years of service. Although exceptions apply, in general, if any of these variables increase (years of service, salary, accrual rate), the amount of your lifetime pension will increase.

Effective October 1, 2019, if you have pensionable service between April 1, 2006 and March 31, 2018, inclusive, your pension will be amended to reflect two changes:

- A basic pension accrual rate of increase of 1.65 per cent, increased from 1.35 per cent, on pensionable salary below the year’s maximum pensionable earnings.

- A corresponding bridge benefit accrual rate decrease from 0.65 to 0.35 per cent.

According to the Income Tax Regulations, the total accrual rate (new pension rate plus new bridge rate) cannot exceed two per cent.