Investing for your future

Whether you are new to your pension plan or ready to retire soon, it’s worth understanding why the plan’s investments are important for your pension.

Why pension investments matter

Whether you’re new to the Teachers’ Pension Plan or ready to retire soon, it’s worth understanding how your pension contributions are invested.

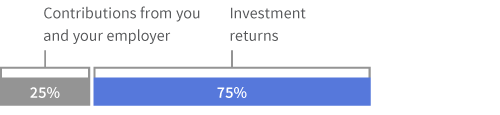

When you retire, only about 25 per cent of your pension is paid by contributions made by you and your employer. The remaining 75 per cent comes from investment income earned on those contributions. This means plan investments are a critical part of your pension.

Who manages your investments

The Teachers’ Pension Board of Trustees oversees your plan’s $37.9 billon investment portfolio. In doing so, the board focuses on the long-term sustainability of the plan.

British Columbia Investment Management Corporation (BCI) manages the plan’s funds. BCI is one of Canada’s largest pension fund investment managers.

How the board and BCI make investment choices

Before any investment decisions are made, the board provides BCI with a set of principles and policies to guide investment decisions:

- Statement of Investment Policies and Procedures—The board developed this guiding document to direct how BCI manages investments. It helps define the strategic asset distribution: the types of assets the plan invests in (known as asset classes). It also sets out how much to invest in each asset class to provide the best balance between potential returns and investment risk.

- Funding policy—The board sets its goals for managing the pension fund and defines the priorities for the plan in this policy. The board reviews the funding policy every three years after it receives the actuarial valuation.

Investment beliefs

The board and BCI are also guided by a set of investment beliefs. These beliefs fall into four categories:

- Governance

- Risk management

- Environmental, social and governance/Climate change

- Portfolio management

A full list of the beliefs and supporting principles is included in the Statement of Investment Policies and Procedures.

Pooling investments for better value

Collaboration is important in the classroom—and in the world of investments.

Member and employer contributions are pooled with funds from other investors. That allows the plan to take advantage of opportunities available only to large investors. Pooling funds can also save on certain investment costs, leaving more money to pay for your pension.

Measuring investment success

Your plan uses actuarial valuations to assess the plan’s funding. Every three years, an independent financial expert (called an actuary) performs the valuation. This valuation is like a report card; it shows whether the plan is on track to meet its goals. As part of each valuation, the actuary defines an assumed long-term rate of investment return for the plan. The board and BCI aim to achieve this rate of return over the long term.

Read the latest annual report to learn how the plan’s investments are performing over the long term.

You can be confident about your retirement income. When you contribute to the plan, you’re saving for your future. Your contributions are carefully invested by the plan and BCI. Your investments matter.